Remember Robert Durst? He's the billionaire elder scion of Seymour Durst's real estate empire who escaped conviction on not one, not two, but three obvious-to-an-idiot murder suspicions. His life is the stuff of movies (there are at least two, plus a number of Law and Orders) and he continues to live and soak in his own dirty soul right here in NYC. So what does that have to do with Lefferts? I'll get to that in a long minute.

As the Q learns more and more about the true fiscal machinery behind seemingly organic gentrification, he begins to wonder whose town this is anyway. At the Community Board meeting the other night an older member asked what's both an absurd and profound question related to zoning. He asked "whose land is it anyway, that these developers are taking?" On the one hand, the query is laughable. It's private property of course, and they pay for it, with some form of currency, even if it's all on paper. I even snottily answered the question by interrupting "go far enough back and the land is actually the Indians'" but given the native people's looser view of the public/private partnership, it might be more appropriate to say "God" or someone of his stature actually "owns" the land. Our whole society and notion of wealth and growth stems from private ownership of the very land beneath our feet, and it's really an ingenious proposition when you think about it. Without that simple concept you get no United States, or Louisiana Purchase, or lawn mowers. You can't get loans, you can't build empires, and you sure as heck can't grow a tree and call it yours. So that's a bit of fiscal machinery at play. Sometimes it's fun to remember that the very basis of things is not actually self-evident, but constructed.

The Q don't know about you, but I was actually floored to learn that 115 Ocean traded for $26 million. Not because I have any concept of that much money, but because it was more than 2 1/2 times what another supposedly sophisticated investor paid four years ago. And at this moment, 115 is the same much-maligned much-neglected dump it was back then. No improvements to speak of, still on the list of worst landlords. Granted, the land beneath our feet is seemingly made of black gold these days, so speculation is inevitable. But supposedly "sophisticated" investors don't usually jump in whole hog without an exit strategy. Do they? I mean, the building is basically "worth" $300 s/f now. There is no conceivable way the building can make money as a rent-stabilized building at that valuation. With the rent laws up for review this summer in Albany, that's a heck of a lot of confidence, don't you think? Because either they have to radically change the building in six months (which is not legally possible in such short order) or have some bug in their ear (probably not Bob Marley) telling them "every little thing is gonna be all right." If the rent laws ain't gonna change, and you have a "friend" who knows that for sure, well then I guess you could plan for the long haul. Hmmm. Look, at this point a moneyed developer is going to know, or have lobbyists who know, ALL the relevant players Upstate, and a pretty good idea of how things are going to roll. The rest of us may find us putting faith in a rigged outcome.

Of course, it's not just this one building. That line in the statement from the realtor that 115 was sold to "a local family that has been investing in Brooklyn for multiple years." makes you think its Andy and Opie and Aunt Bea who aare now buying up Central Brooklyn (with Barney as the lovable super?) And who did this lovely NYC family business buy 115 from but the ethically-challenged group called Burke Leighton, led by Freddy Sayegh and some other unholy roller named Sammy (both pictured here - as you can see Sammy seems quite excited in this head shot. Go get 'em Sammy!)

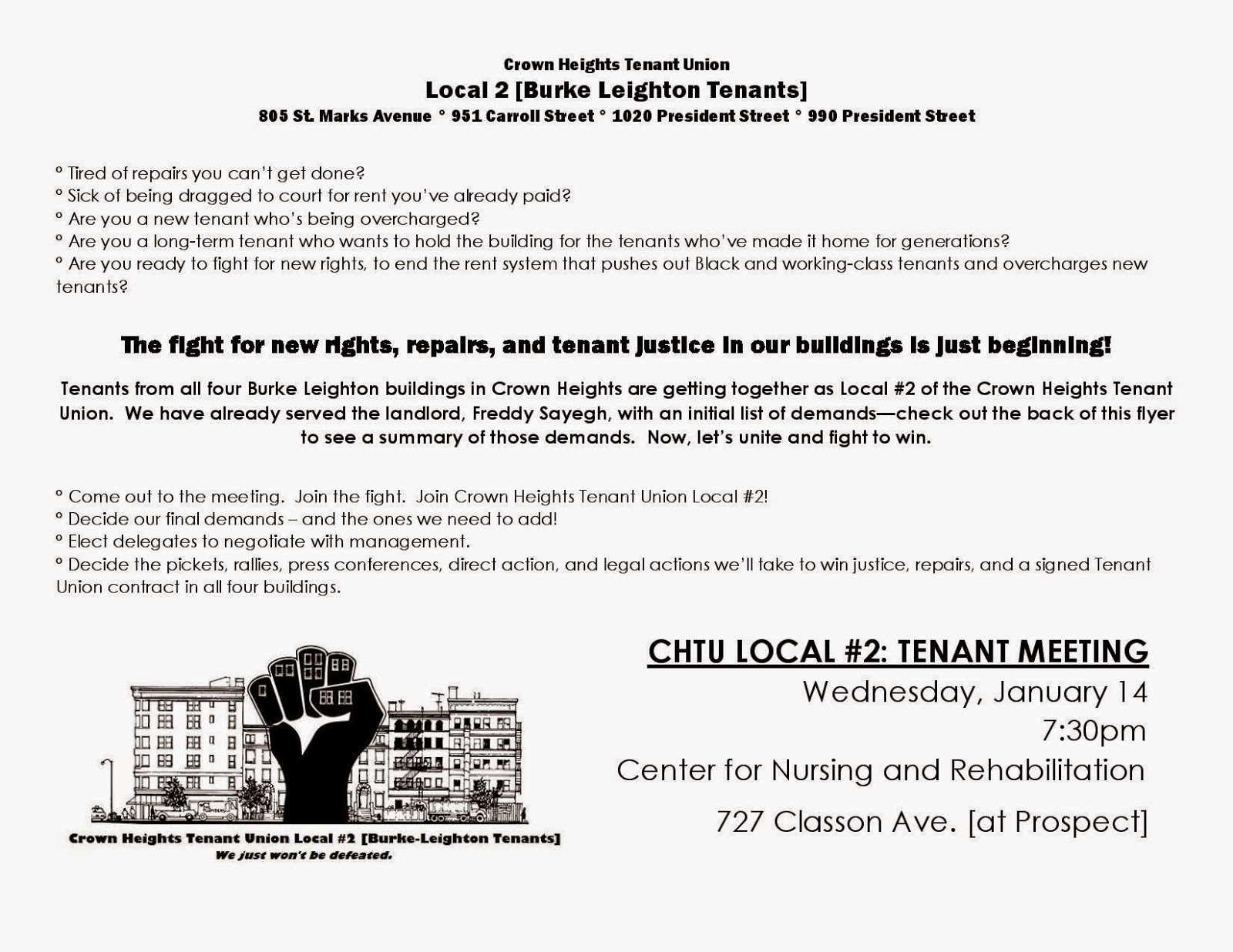

So Burke Leighton made a killing on this sale. Recognize any of these buildings? BL seem to be in the habit of buying up all kinds of buildings in our area, and, it would seem by the sale of 115, "preparing them" for resale. How do I know Freddy Sayegh and his team at Burke Leighton are ethically-disabled? Because they are one of the prime targets of the Crown Heights Tenants Union, a brave bunch of tenants who have banded together - old-timer and new-timer - to take on the nasty treatment that ALL of the tenants are being given in order to get them out and jack up the rent 20% with each new lease. That's the loophole that fast-tracks a building right out of rent stabilization on the way to the absurdly high prevailing market rates. Below's the poster for a tenant organizing meeting for Burke Leighton tenants coming up this Wednesday, so by all means if you live in any of these or other BL buildings please go! Remember, your owner is probably behind an LLC name (like 115 Ocean, which was called Lincoln Prospect Associates), so do the diligence if you can and find out who's behind the mask. You may be helping tons of fellow tenants to learn that they too are part of this group that's organizing.

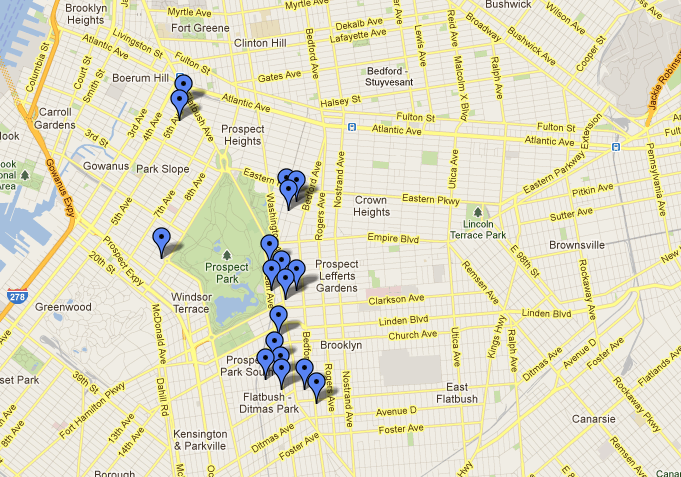

All good, and weird. I started wondering who this "family" business might be, the one that bought 115 at such a ridiculously high markup. I thought to myself, well, maybe it's just another one of these companies buying up tons of buildings right now. Maybe one that's bought THIS many buildings:

Pretty impressive, no? One might even call it a geographic strategy...one that dovetails nicely with the current trend of fast-paced gentrification. As you well know, there are tons more buildings than just the ones noted on the above map, a map that appears proudly on Burke Leighton's website. But between them and Pinnacle and Shamco and BCB and a handful of others, most of the buildings round here have been bought and sold and leveraged many times in very recent years. So what, you might say. The big money figured there were low lying fruit to be plucked. That's how capitalism works, and why should we care?

Well, for one thing, these big asset firms aren't buying up candy for resale. They're purchasing people's homes. Granted those people don't own their homes, but many of them have been paying rent for decades and have made landlords money in the process. They're part of the fabric of the neighborhood, the schools, the shops, the churches. You could go as far as to say they ARE the neighborhood, for what is a neighborhood but the people who live there and raise families and play in the playgrounds and shop the stores? (You could say that's old-fashioned of me, but just think how so many distinct neighborhoods of Manhattan have disappeared into anonymity as they've been turned into monolithic worker dorms, many designed for the young professional who's here to start a career, marry and move away. Am I being glib? Maybe, but think of the old Lower East Side, or Chelsea, and how it's changed for the blander. Progress, maybe. Or just plain part of the greater corporatization of the culture. And we read just this weekend (NY Times: Why the Doorman Is Lonely) that one quarter...yes 25%...of all NYC coops and condos are owned by people as a second home. They don't even REALLY live here, or pay income tax. And they say we have a housing shortage.

I've echoed what's been written elsewhere, about how these very small number of players are literally owning the 'hood. It's not new. But maybe you haven't heard about this one - Bennat Charatan Berger - and what I found out kinda blew my mind. BCB is one of the companies that the CHTU is fighting. And oddly, as I was checking out their homepage, I ran across this tidbit.

But here's the intrigue. If the name Debrah Lee Charatan doesn't ring a bell, maybe you should take a closer look at the story of that guy I mentioned at the top of the post - Robert Durst. Apologies to Wikipedia for quoting so liberally, but they provide all the details in a wonderful summary. If haven't read the abbreviated version of his story, you simply MUST:

So beyond learning that one can plead Asperger's as an excuse for chopping someone up into tiny bits with a paring knife, we also learn that Durst became a gentrifier in Harlem in 2011. Who helped him find the place? Why, BCB Property Management of course.

Because Durst's second wife, the one he didn't murder (so far), is Debrah Lee Charatan. And she's still married to himby the way. And the family company she runs with her son, Durst's stepson, BCB, is clearly on a mission to build an empire of its own. Maybe as some sort challenge to the younger Durst brother, who is still enormously successful and apparently terrified of his older brother to this day?

All of the above, dear reader, is true, as far as my sleuthing can ascertain. But one bit of speculation could either turn this into a big story or a "the Q has gone off the rails" fable.

What if BCB and Burke Leighton were conspiring together to ratchet up the prices of buildings like 115 Ocean? I don't know for a fact that BCB was the buyer, making BL a big, big profit. BUT, if they (or any other real estate concerns) colluded to increase the price of the building and then sold one more time - this time to an unsuspecting gullible party, they could split the diff. You know, the way a shill bidder can bid up the price to net the seller more dough at auction. Just a hunch. Because otherwise, I just don't see how any of it makes any sense.

When people's very lives and homes are at stake, the Q thinks it warrants a ton of action by elected officials and the D.A. and the media to figure out who these new Lords of Flatbush are. By jacking up the price of the buildings themselves, they make them completely unworkable as a business to landlords. It was one thing when tenants paying $500 - $1000 for an apartment fed a building worth a couple million. You can still make money. But when an 89 unit building costs $26 million? And it's a dump needing oodles of repairs? It don't take Warren Buffet to see where this is heading.

To say the very least, the story unfolding before our eyes is much richer, much more sinister, and much more interesting, than I ever could have imagined.

As the Q learns more and more about the true fiscal machinery behind seemingly organic gentrification, he begins to wonder whose town this is anyway. At the Community Board meeting the other night an older member asked what's both an absurd and profound question related to zoning. He asked "whose land is it anyway, that these developers are taking?" On the one hand, the query is laughable. It's private property of course, and they pay for it, with some form of currency, even if it's all on paper. I even snottily answered the question by interrupting "go far enough back and the land is actually the Indians'" but given the native people's looser view of the public/private partnership, it might be more appropriate to say "God" or someone of his stature actually "owns" the land. Our whole society and notion of wealth and growth stems from private ownership of the very land beneath our feet, and it's really an ingenious proposition when you think about it. Without that simple concept you get no United States, or Louisiana Purchase, or lawn mowers. You can't get loans, you can't build empires, and you sure as heck can't grow a tree and call it yours. So that's a bit of fiscal machinery at play. Sometimes it's fun to remember that the very basis of things is not actually self-evident, but constructed.

The Q don't know about you, but I was actually floored to learn that 115 Ocean traded for $26 million. Not because I have any concept of that much money, but because it was more than 2 1/2 times what another supposedly sophisticated investor paid four years ago. And at this moment, 115 is the same much-maligned much-neglected dump it was back then. No improvements to speak of, still on the list of worst landlords. Granted, the land beneath our feet is seemingly made of black gold these days, so speculation is inevitable. But supposedly "sophisticated" investors don't usually jump in whole hog without an exit strategy. Do they? I mean, the building is basically "worth" $300 s/f now. There is no conceivable way the building can make money as a rent-stabilized building at that valuation. With the rent laws up for review this summer in Albany, that's a heck of a lot of confidence, don't you think? Because either they have to radically change the building in six months (which is not legally possible in such short order) or have some bug in their ear (probably not Bob Marley) telling them "every little thing is gonna be all right." If the rent laws ain't gonna change, and you have a "friend" who knows that for sure, well then I guess you could plan for the long haul. Hmmm. Look, at this point a moneyed developer is going to know, or have lobbyists who know, ALL the relevant players Upstate, and a pretty good idea of how things are going to roll. The rest of us may find us putting faith in a rigged outcome.

|

| Sammy |

|

| Freddy |

So Burke Leighton made a killing on this sale. Recognize any of these buildings? BL seem to be in the habit of buying up all kinds of buildings in our area, and, it would seem by the sale of 115, "preparing them" for resale. How do I know Freddy Sayegh and his team at Burke Leighton are ethically-disabled? Because they are one of the prime targets of the Crown Heights Tenants Union, a brave bunch of tenants who have banded together - old-timer and new-timer - to take on the nasty treatment that ALL of the tenants are being given in order to get them out and jack up the rent 20% with each new lease. That's the loophole that fast-tracks a building right out of rent stabilization on the way to the absurdly high prevailing market rates. Below's the poster for a tenant organizing meeting for Burke Leighton tenants coming up this Wednesday, so by all means if you live in any of these or other BL buildings please go! Remember, your owner is probably behind an LLC name (like 115 Ocean, which was called Lincoln Prospect Associates), so do the diligence if you can and find out who's behind the mask. You may be helping tons of fellow tenants to learn that they too are part of this group that's organizing.

All good, and weird. I started wondering who this "family" business might be, the one that bought 115 at such a ridiculously high markup. I thought to myself, well, maybe it's just another one of these companies buying up tons of buildings right now. Maybe one that's bought THIS many buildings:

Pretty impressive, no? One might even call it a geographic strategy...one that dovetails nicely with the current trend of fast-paced gentrification. As you well know, there are tons more buildings than just the ones noted on the above map, a map that appears proudly on Burke Leighton's website. But between them and Pinnacle and Shamco and BCB and a handful of others, most of the buildings round here have been bought and sold and leveraged many times in very recent years. So what, you might say. The big money figured there were low lying fruit to be plucked. That's how capitalism works, and why should we care?

Well, for one thing, these big asset firms aren't buying up candy for resale. They're purchasing people's homes. Granted those people don't own their homes, but many of them have been paying rent for decades and have made landlords money in the process. They're part of the fabric of the neighborhood, the schools, the shops, the churches. You could go as far as to say they ARE the neighborhood, for what is a neighborhood but the people who live there and raise families and play in the playgrounds and shop the stores? (You could say that's old-fashioned of me, but just think how so many distinct neighborhoods of Manhattan have disappeared into anonymity as they've been turned into monolithic worker dorms, many designed for the young professional who's here to start a career, marry and move away. Am I being glib? Maybe, but think of the old Lower East Side, or Chelsea, and how it's changed for the blander. Progress, maybe. Or just plain part of the greater corporatization of the culture. And we read just this weekend (NY Times: Why the Doorman Is Lonely) that one quarter...yes 25%...of all NYC coops and condos are owned by people as a second home. They don't even REALLY live here, or pay income tax. And they say we have a housing shortage.

I've echoed what's been written elsewhere, about how these very small number of players are literally owning the 'hood. It's not new. But maybe you haven't heard about this one - Bennat Charatan Berger - and what I found out kinda blew my mind. BCB is one of the companies that the CHTU is fighting. And oddly, as I was checking out their homepage, I ran across this tidbit.

Founded in 2008 by the mother and son team of Debrah Lee Charatan and Bennat Charatan Berger, BCB has preserved and improved more than 36 multi-family and mixed use buildings in Manhattan and Brooklyn.How charming! A family business...wait. Isn't that the language used by The Real Deal when talking about the unnamed company that bought 115 Ocean from Burke Leighton? I know companies often have relatives working together. But it struck me as odd that BCB makes such a point of it, as if to say "we must have integrity, being that we're a mother and son business." Perhaps that's an image they're trying to cultivate, and that they're selling to others through P.R.

But here's the intrigue. If the name Debrah Lee Charatan doesn't ring a bell, maybe you should take a closer look at the story of that guy I mentioned at the top of the post - Robert Durst. Apologies to Wikipedia for quoting so liberally, but they provide all the details in a wonderful summary. If haven't read the abbreviated version of his story, you simply MUST:

Early life

One of four children, Durst grew up in Scarsdale, New York, and attended Scarsdale High School. He completed his undergraduate degree at Lehigh University and attended graduate school at UCLA. At age 7 Durst reportedly witnessed his mother's apparent suicide; she either fell or jumped from the roof of the family's mansion. According to Reader's Digest, Durst underwent extensive counseling because of his mother's death, and doctors found that his "deep anger" could lead to psychological problems, including schizophrenia. Durst went on to become a real estate developer in his father's business; however, it was his brother Douglas who was later appointed to run the family business. The appointment in the 1990s caused a rift between Robert and his family, and he became estranged from them.Fugitive

In 1973, Durst married Kathleen McCormack, who disappeared in 1982. Her case remained unsolved for 18 years when New York State Police re-opened the criminal investigation. On December 24, 2000, Durst's long-time friend, Susan Berman, who was believed to have knowledge of McCormack's disappearance, was found murdered execution-style in her Benedict Canyon, California house. Durst was questioned in both cases but not charged. According to prosecutors, Durst moved to Texas in 2000 and began cross-dressing to divert attention from the disappearance of McCormack.In 2001, Durst was arrested in Galveston, Texas, shortly after body parts of his elderly neighbor, Morris Black, were found floating in Galveston Bay, but was released on bail. Durst missed his court hearing and was declared the first billion-dollar fugitive in the US. He was caught in Bethlehem, Pennsylvania, at a Wegmans Supermarket, after trying to shoplift a chicken sandwich, Band-Aids, and a newspaper, even though he had $500 cash in his pocket. A police search of his rented car yielded $37,000 in cash, two guns, marijuana and Black's driver's license.Trial

In 2003, Durst went on trial for the murder of Morris Black. He hired defense attorney Dick DeGuerin and claimed self-defense. During cross-examination, Durst admitted to using a paring knife, two saws and an axe to dismember Black's body before dumping his remains in Galveston Bay. He was diagnosed with Asperger Syndrome, which the defense argued explained his behavior. The jury acquitted him of murder. In 2004, Durst pleaded guilty to two counts of bond jumping and one count of evidence tampering. As part of a plea bargain, he received a sentence of five years and was given credit for time served, requiring him to serve about three years in prison. Durst was paroled in 2005. The rules of his release required him to stay near his home; permission was required to travel.Second arrest

In December 2005, Durst made an unauthorized trip to the boarding house where Black had been killed and to a nearby shopping mall. At the mall, he ran into the presiding judge from his murder trial, Judge Susan Criss. Due to this incident, the Texas Board of Pardons and Paroles determined that Durst had violated the terms of his parole, and he was returned to jail. He was released again from custody on March 1, 2006. In 2011, it was reported that Durst had purchased a townhouse in Harlem, and his family confirmed that he was living there at least some of the time.Third arrest:

In July 2014, Durst was arrested after turning himself in to police following an incident at a Houston CVS drugstore in which he allegedly exposed himself without provocation and urinated on a rack of candy. He then left the store and casually walked down the street. Durst was charged with criminal mischief and is currently awaiting trial. If convicted of the misdemeanor charge, he may serve up to a year in prison and may be subject to a $2000 fine.

So beyond learning that one can plead Asperger's as an excuse for chopping someone up into tiny bits with a paring knife, we also learn that Durst became a gentrifier in Harlem in 2011. Who helped him find the place? Why, BCB Property Management of course.

Because Durst's second wife, the one he didn't murder (so far), is Debrah Lee Charatan. And she's still married to himby the way. And the family company she runs with her son, Durst's stepson, BCB, is clearly on a mission to build an empire of its own. Maybe as some sort challenge to the younger Durst brother, who is still enormously successful and apparently terrified of his older brother to this day?

All of the above, dear reader, is true, as far as my sleuthing can ascertain. But one bit of speculation could either turn this into a big story or a "the Q has gone off the rails" fable.

What if BCB and Burke Leighton were conspiring together to ratchet up the prices of buildings like 115 Ocean? I don't know for a fact that BCB was the buyer, making BL a big, big profit. BUT, if they (or any other real estate concerns) colluded to increase the price of the building and then sold one more time - this time to an unsuspecting gullible party, they could split the diff. You know, the way a shill bidder can bid up the price to net the seller more dough at auction. Just a hunch. Because otherwise, I just don't see how any of it makes any sense.

When people's very lives and homes are at stake, the Q thinks it warrants a ton of action by elected officials and the D.A. and the media to figure out who these new Lords of Flatbush are. By jacking up the price of the buildings themselves, they make them completely unworkable as a business to landlords. It was one thing when tenants paying $500 - $1000 for an apartment fed a building worth a couple million. You can still make money. But when an 89 unit building costs $26 million? And it's a dump needing oodles of repairs? It don't take Warren Buffet to see where this is heading.

To say the very least, the story unfolding before our eyes is much richer, much more sinister, and much more interesting, than I ever could have imagined.